To locate the finest mortgage lender for your preferences, start off by checking your credit score. Should you have truthful credit or down below, taking techniques to transform your score may help you qualify for economical house loan conditions.

Whenever you refinance your home finance loan loan, you replace your present-day loan having a new loan. It is possible to refinance to get a decreased fascination level, lower your month to month payment or get cash out to include personal debt. A refinance can have a remarkable, good impact on your funds in the two the shorter and long-lasting.

You’ll also need to supply extra documentation on top of the normal mortgage loan paperwork to tell you about have usage of these accounts.

Whether or not you really want to worry oneself with overpaying to shrink the financial debt is depending on in which you analyzed. British pupils have a far more calm, suggests-analyzed method, even though US learners face a harsher system and thus

Three times before the scheduled closing date of your home loan, the lender must present the closing disclosure. This authorized document presents the ultimate phrases with the loan and also the complete closing expenses.

Eligibility: To qualify, you must be no less than 62 decades old, are in the residence as your primary home, have significant equity in your home, and show up at a counseling session having a HUD-accredited counselor.

Any IRA and 401(k) belongings must be fully vested. They must even be “totally available to the borrower, not subject matter to your withdrawal penalty, and never be presently used for a source of income.”

Steady cash flow can be a problem for many senior citizens, which could make accessing fairness by using a property finance loan refinance, household fairness loan or property fairness line of credit history a tempting alternative.

After you indicator a mortgage loan, you conform to repay a certain volume each month moreover curiosity with the expression with the mortgage loan. Most home loans past fifteen or 30 decades, but some lenders supply other mortgage terms.

Compute full amount of money paid together with desire by multiplying the monthly payment by full months. To estimate complete fascination compensated subtract the loan total from the overall volume compensated. This calculation is accurate but might not be exact on the penny because some genuine payments may fluctuate by a few cents.

In a house fairness sharing agreement, an Trader provides a homeowner profit exchange for your part of their dwelling's foreseeable future value.

So, what helps make acquiring a house loan various for a senior? It all depends upon your determination and funds.

USDA Loans: The USDA also includes a no-down-payment loan program. To qualify for this kind of mortgage, you need to invest in a home in a very rural region. The USDA home finance loan also has optimum cash flow restrictions based upon your family dimension and zip code. Like other loan varieties, fees may vary.

What's the 62 Furthermore loan? The 62 Moreover loan is usually a variety of reverse home finance loan designed for homeowners aged sixty two and older. It enables seniors to transform a part of their residence equity into dollars, which may be employed for any 65 loan goal.

Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Michael Bower Then & Now!

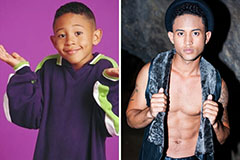

Michael Bower Then & Now! Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now!